Health and Wellness Account Resources

Guides, articles, how-to’s, and more covering HSAs, FSAs, HRAs, Lifestyle Spending and Medical Travel Accounts, and general financial health and wellness.

Guides

Featured Content

Report

Lively's HSA Snapshot

Webinar

HSAs Without the Headaches

Webinar

Invest in your employees during open enrollment and beyond

Report

Lively’s Employee Benefits Pulse Check

Report

Benefits and the Great Resignation

Report

Lively’s 2021 HSA Spend Report

Report

HSA Account Holder Insights

Guide

Open Enrollment Survival Guide

Report

2021 Wellness & Wealth Report

eBook

How to Position the HDHP/HSA for Employers

eBook

The Health Insurance and HSA Terms Every Employee Should Know

Infographic

Why Telehealth is a Crucial Benefit Offering

Guide

Telehealth: A Critical Component of Your Benefits Offering

Demo

Meet Lively: The Modern HSA

guide

Unlocking the Power of Your HSA

article

Best Ways Benefits Brokers Can Talk About HSAs During Open Enrollment

article

Benefits of Employer HSA Contribution Matching

article

The Employee Benefits that Matter Most Right Now According to HR Leaders

article

Resources for Open Enrollment Success

article

What Financial and Investment Advisors Need to Know About HSAs

article

How to Balance Employee Benefit and HR Administration Needs

article

How Can an HSA Help Bridge the Retirement Gap?

article

What HR Leaders Should Look for in an HSA Provider

article

What Financial Institutions Should Look For in an HSA Partnership

Recent Articles

blog post

How Benefits Brokers Can Effectively Discuss HSAs During Open Enrollment

blog post

Ways Health Savings Account Matching Benefits Employers

blog post

Understand the Employee Benefits That Make the Most Impact

blog post

Resources for a Successful Open Enrollment

blog post

What Financial and Investment Advisors Need to Know About HSAs

blog post

Building a Sustainable People-First Benefits Package: Balancing Employee Benefits and Admin Lift

blog post

How HSAs can Help Americans Bridge the $7 Trillion Retirement Savings Gap

blog post

What to Look for in an HSA Provider—and Why You Should Switch

blog post

What Financial Institutions Should Look For in an HSA Partnership

blog post

Ways You Can Implement a Successful High Deductible Health Plan Strategy

blog post

How the Fastest-Growing HSA Provider Gets Their Employees to Adopt HSAs

blog post

Why HSAs are a Powerful Tool for Financial Institutions to Gain and Retain Commercial Customers

blog post

What Brought Our VP of People to Lively

blog post

Did all of your eligible employees open their Health Savings Accounts? Here’s how to improve participation.

blog post

Designing an LSA Program: Best Practices for Employers

blog post

Empowering Your Workforce with a Lifestyle Spending Account

blog post

Why are MTAs so Popular? The Benefits of Medical Travel Accounts

blog post

Lively’s HSA Snapshot Report Highlights What You Need to Know About HSAs and Your Benefits Mix

blog post

The Advantages of Bundling Your Employees’ Benefits

blog post

Should Employers Consider Adding Lifestyle Spending Accounts as an Employee Benefit?

blog post

Why You Need a Mid-year Financial and Mental Wellness Check-Up

blog post

Does COBRA Have Requirements for Employers?

blog post

What Can I Use My LSA For?

blog post

Lively’s Platform Now Has Over $1 Billion in HSA Assets: What That Means for Us

Calculators

Easily compare health plans, determine yearly HSA contribution amounts, and forecast HSA savings.

Calculators

Easily compare health plans, determine yearly HSA contribution amounts, and forecast HSA savings.

Videos

33 Minutes

[Webinar] Drive Employee Retention with Tax-Deductible Benefits

60 Minutes

[Webinar] Shrinking Attention Spans, Better Benefits: Navigating 2022 Open Enrollment

60 Minutes

[Webinar] HSAs and Financial Wellness: 5 Ways to Boost Employee Resiliency During the Pandemic

60 Minutes

[Webinar] HSA Spending & COVID-19: How to Adapt Benefits to Healthcare Trends

1 Minute

The Value of a High Deductible Health Plan (HDHP)

1 Minute

Pairing an HSA with your HDHP

1 Minute

How to Choose a Healthcare Plan

60 Minutes

[Webinar] How COVID-19 Has Transformed HSAs and Why They Enhance Today’s Benefit Packages

60 Minutes

[Webinar] How to Manage Increasing Healthcare Costs With Consumer-Driven Health Plans

3 Minutes

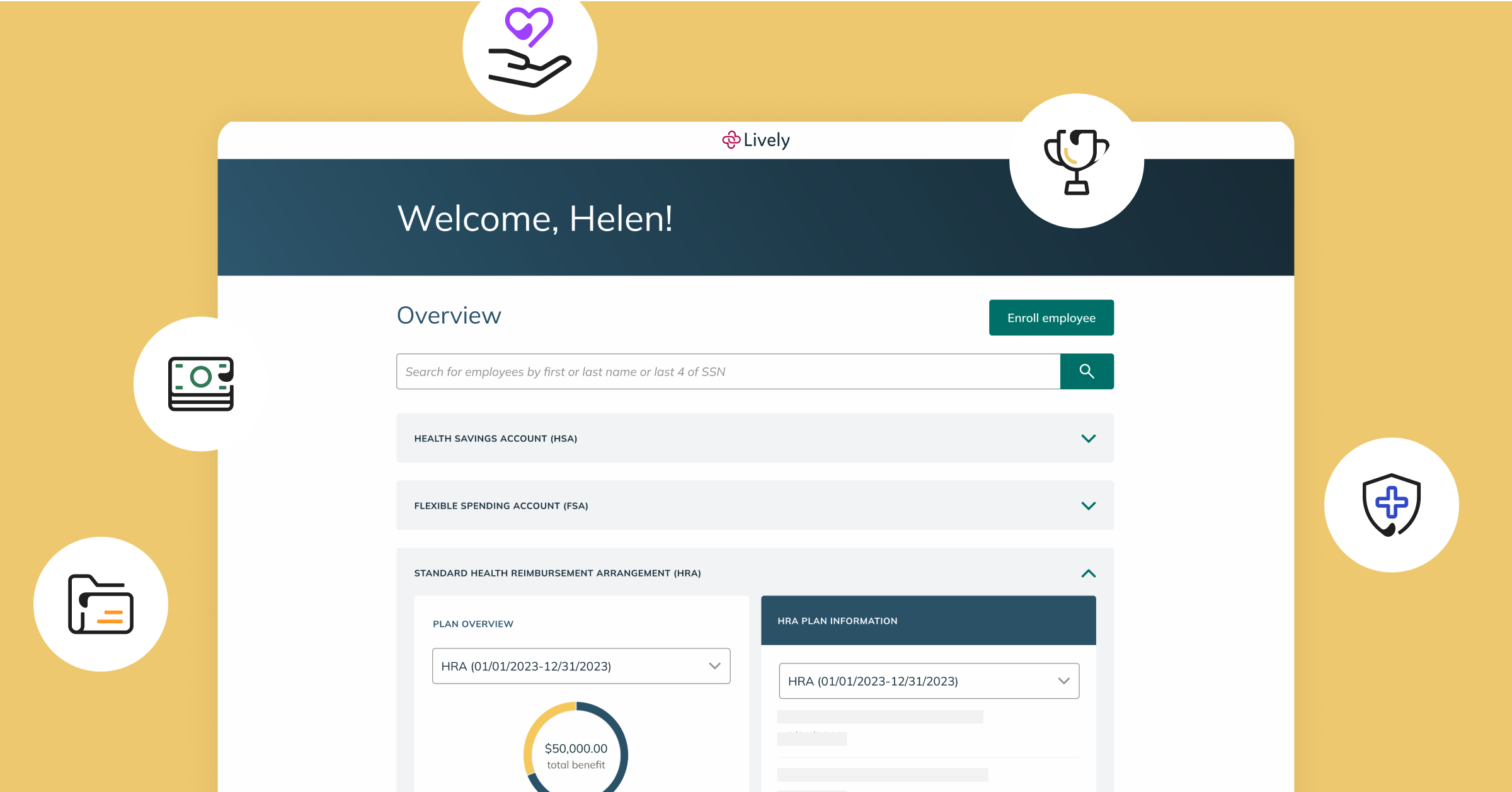

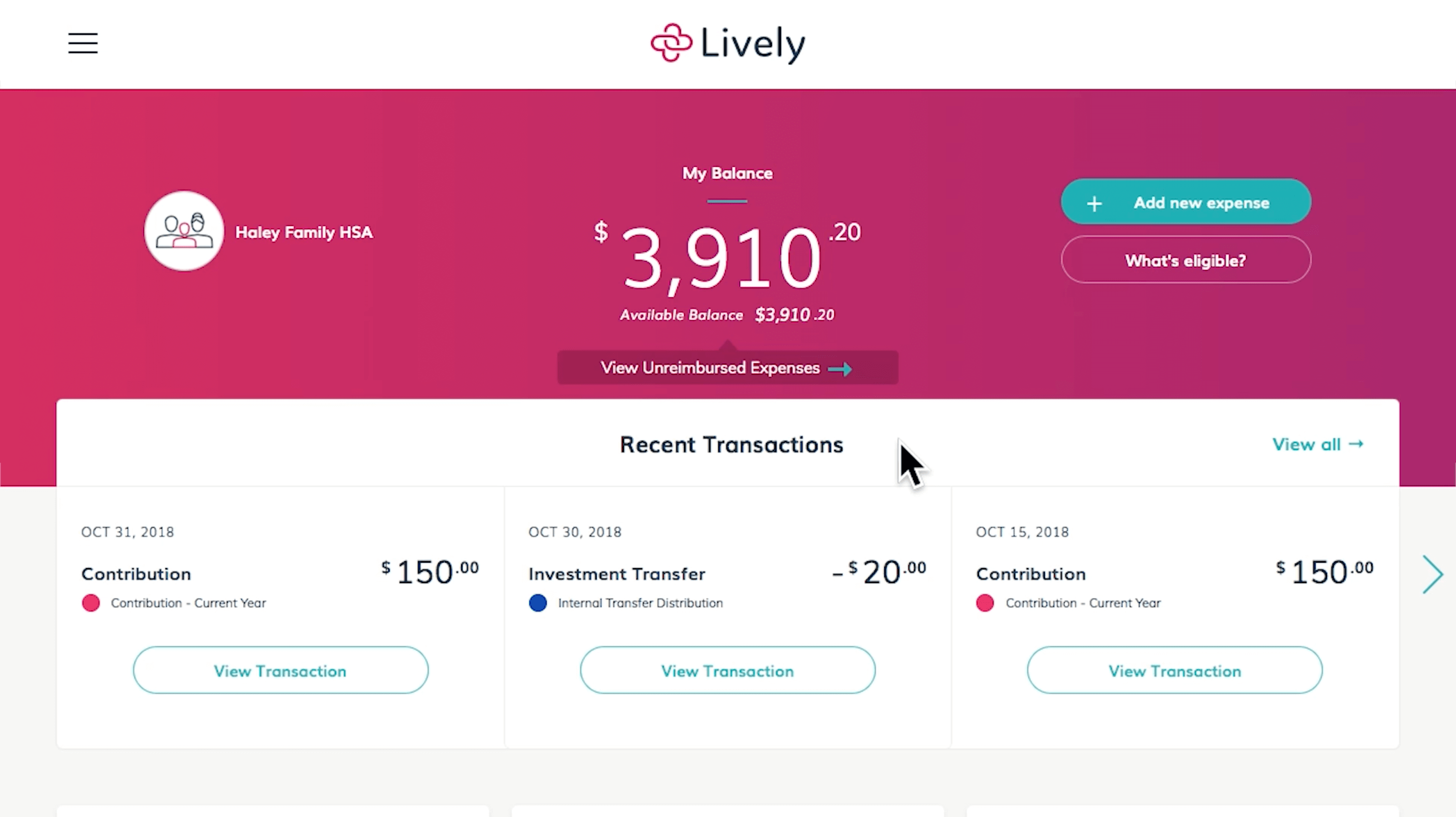

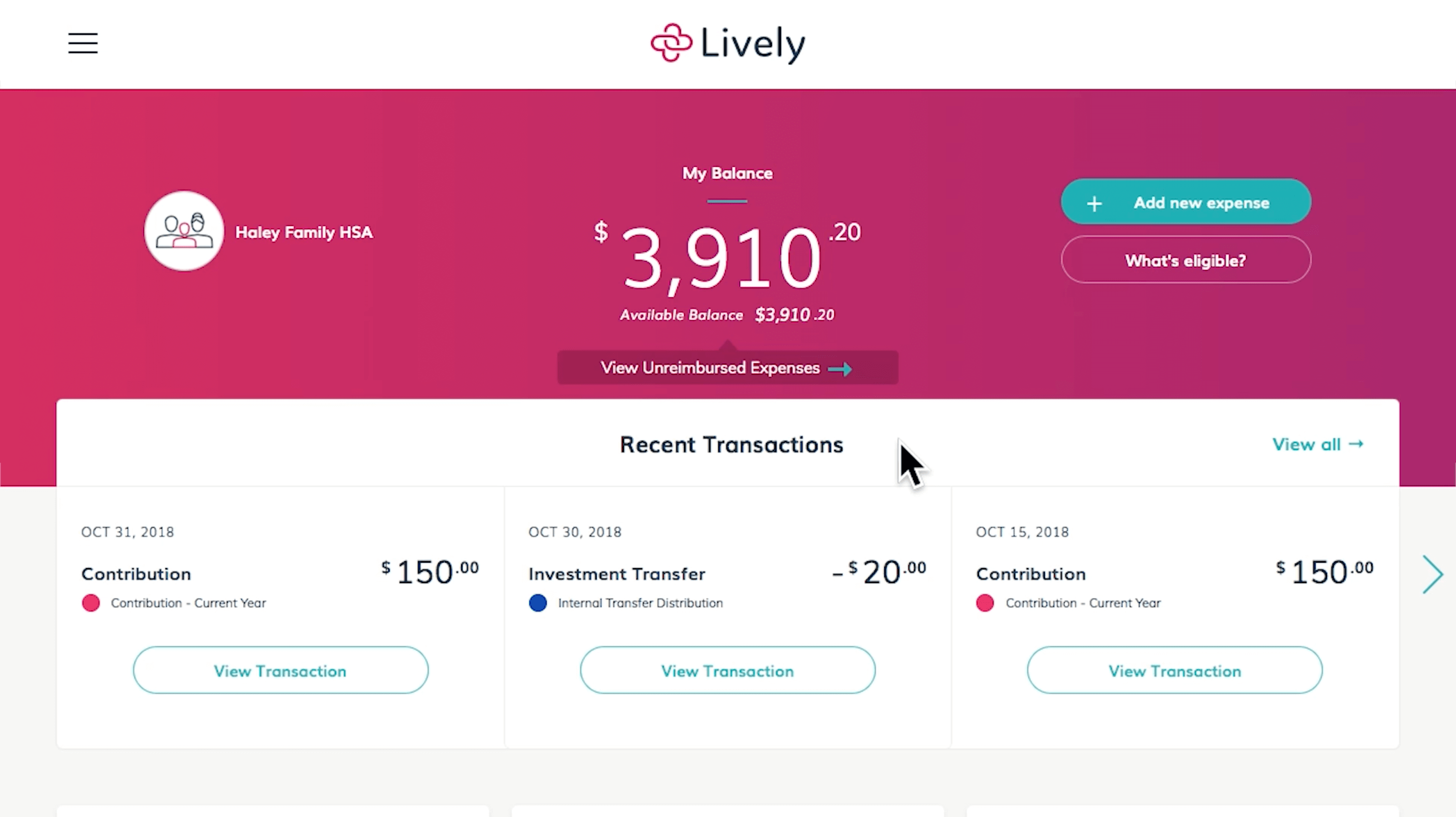

Lively Employee Dashboard Overview

1 Minute

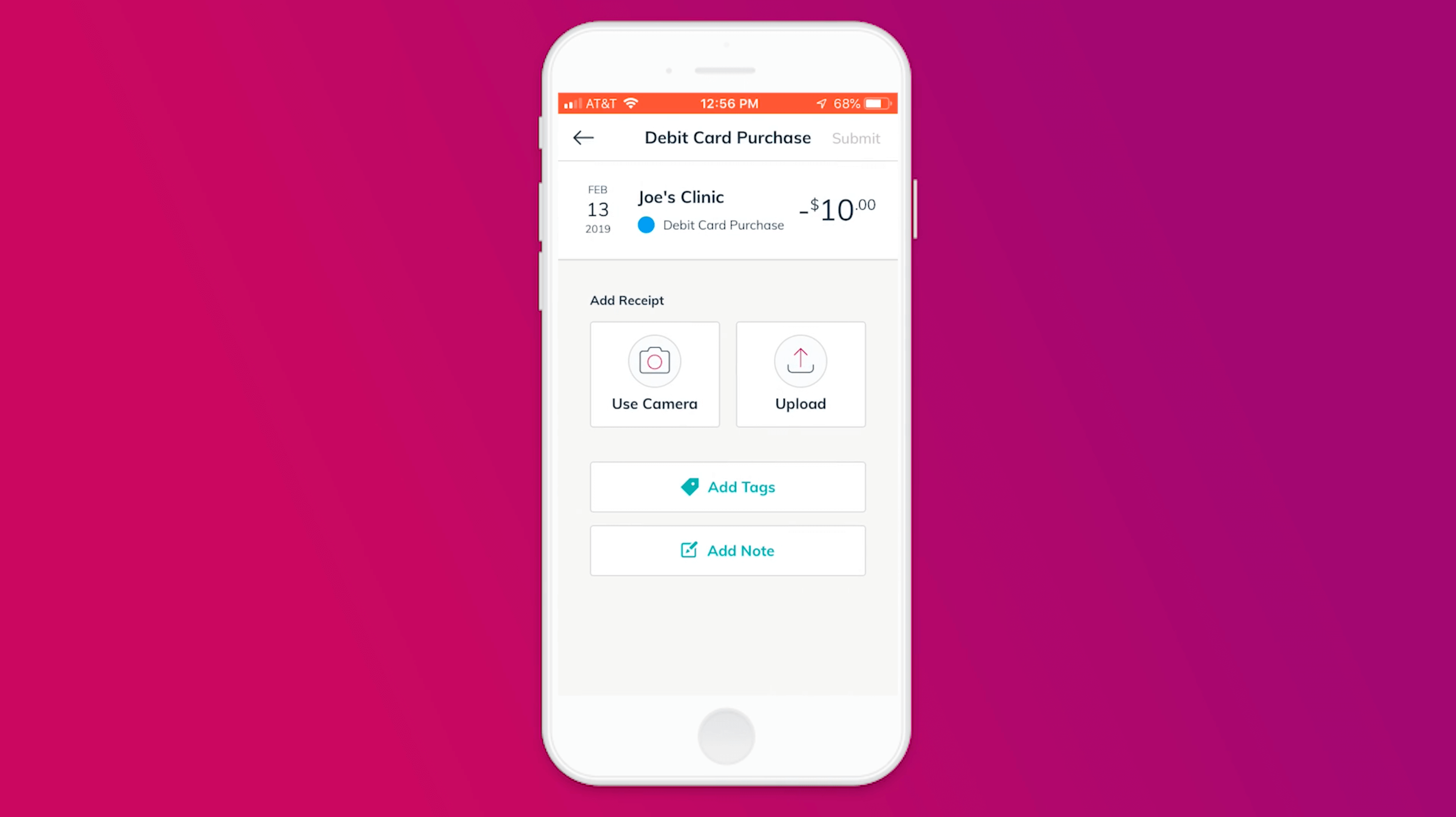

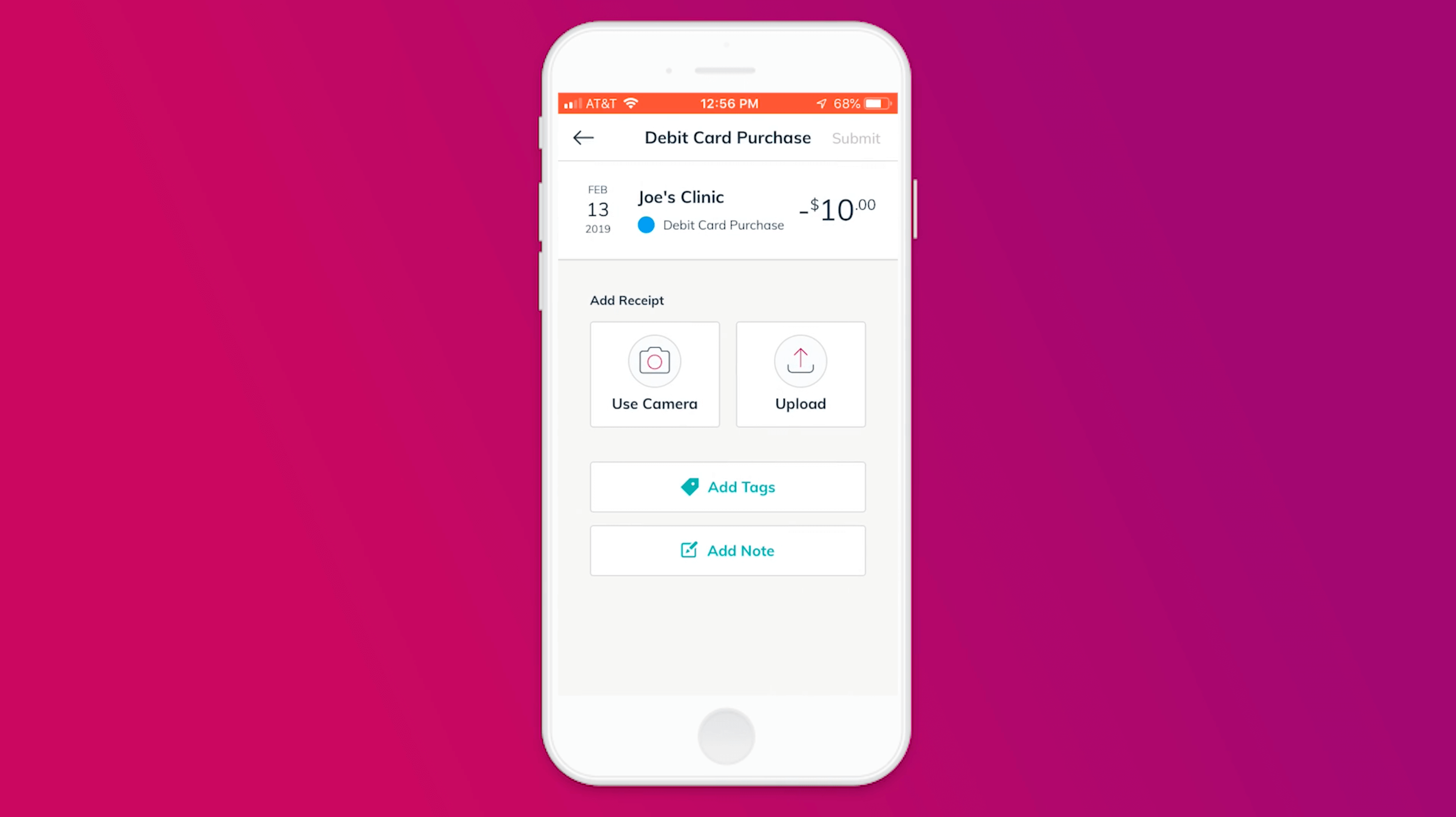

Lively Mobile App Overview

2 Minutes

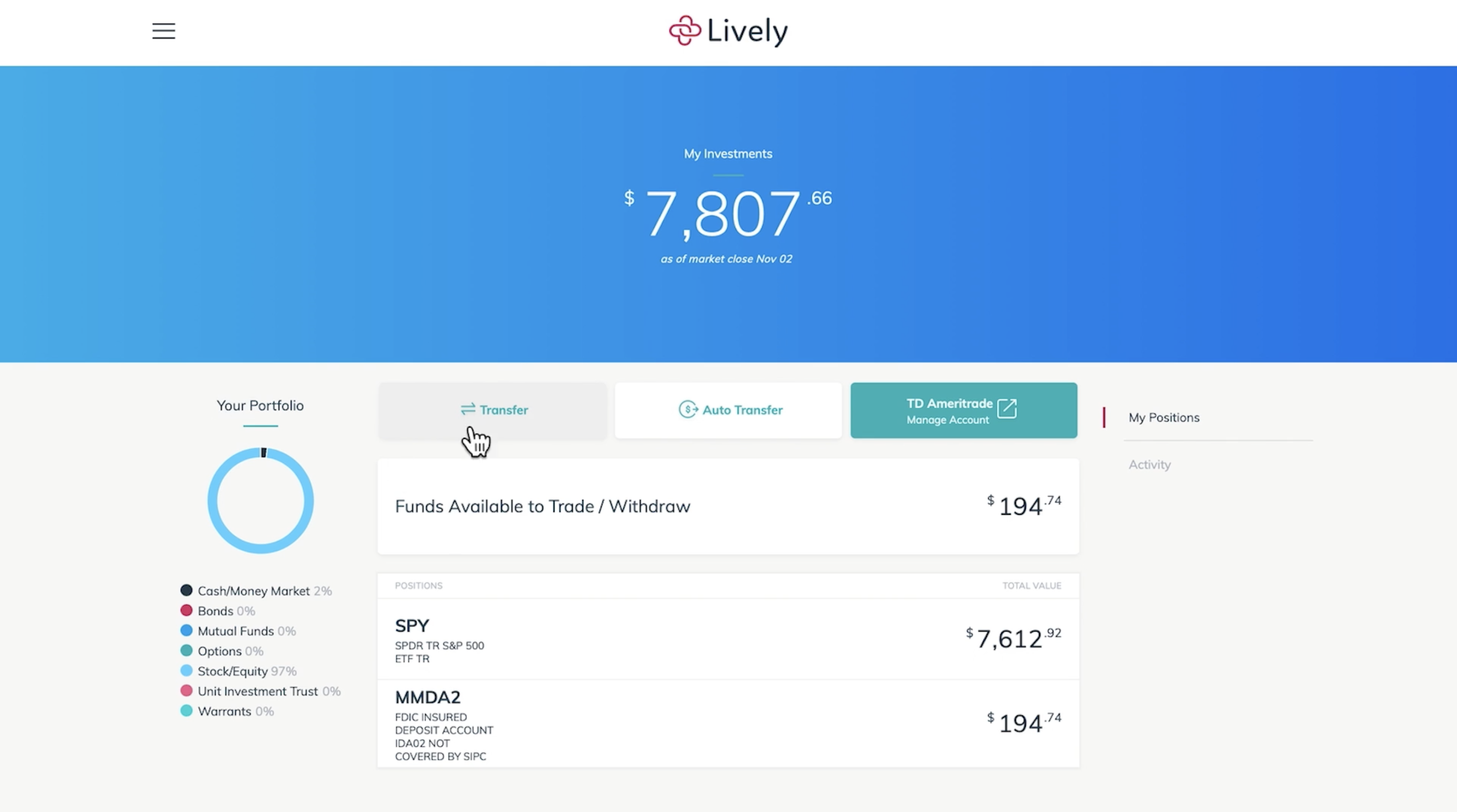

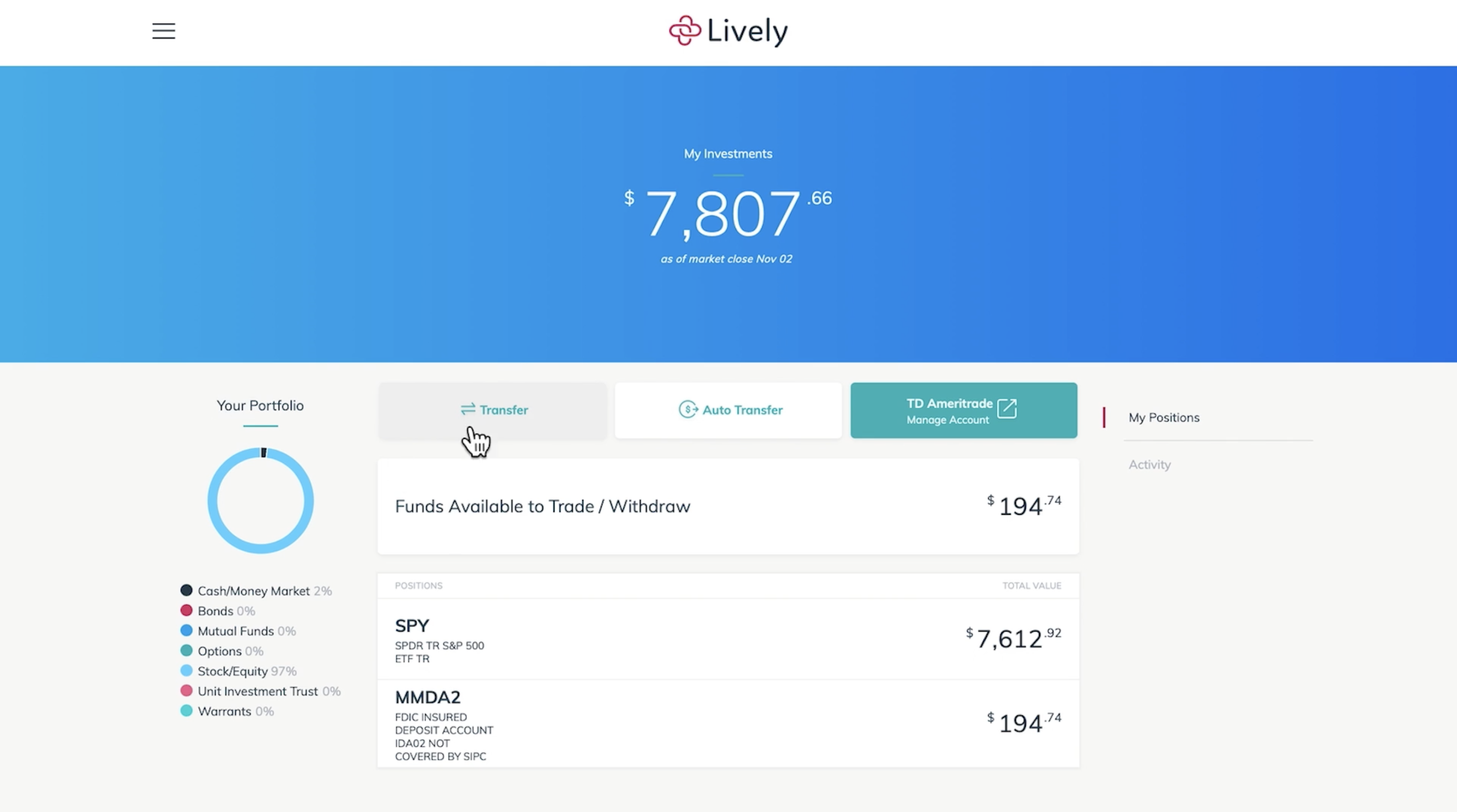

HSA Investments Overview

3 Minutes

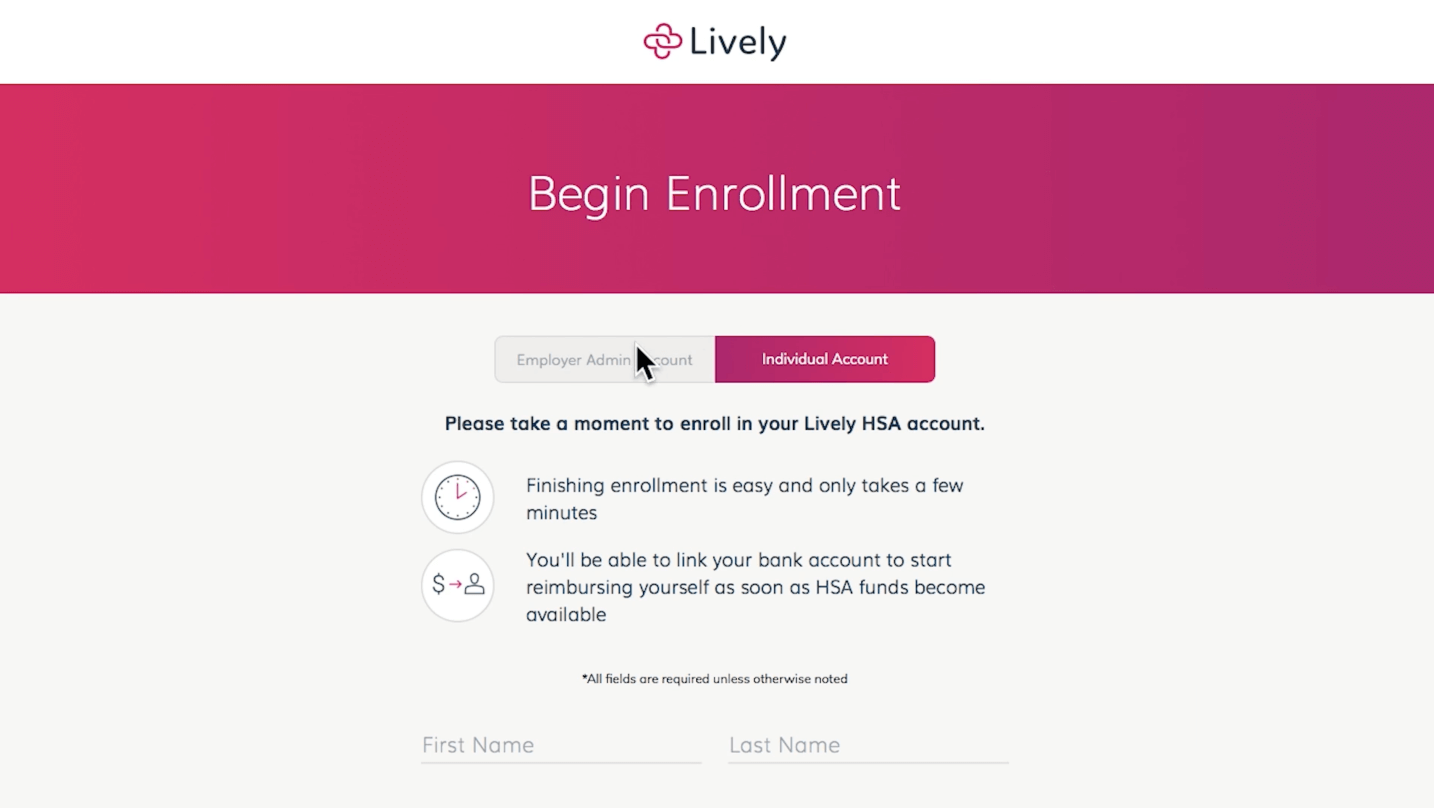

Employer HSA Signup

2 Minutes

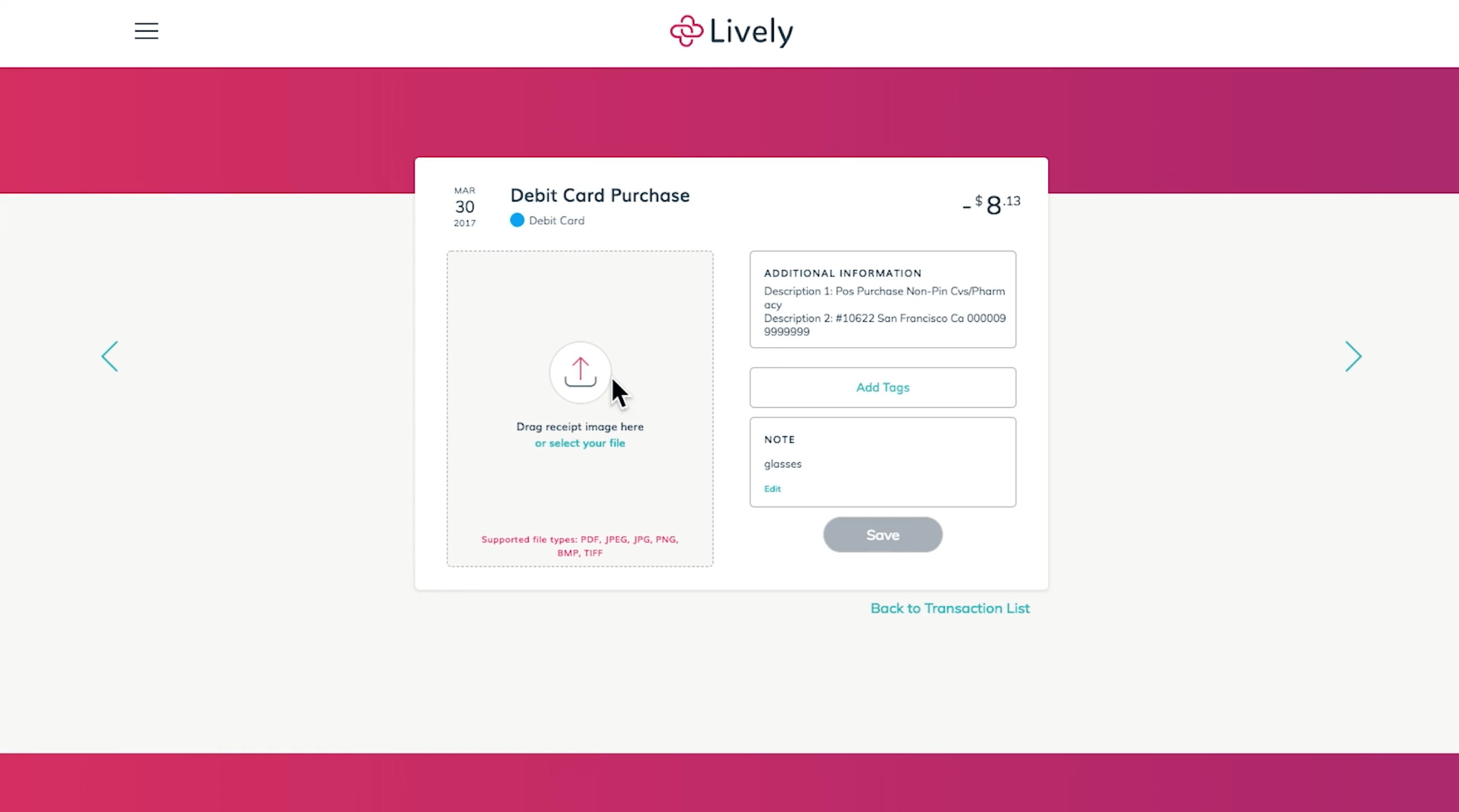

HSA Reimbursements

2 Minutes

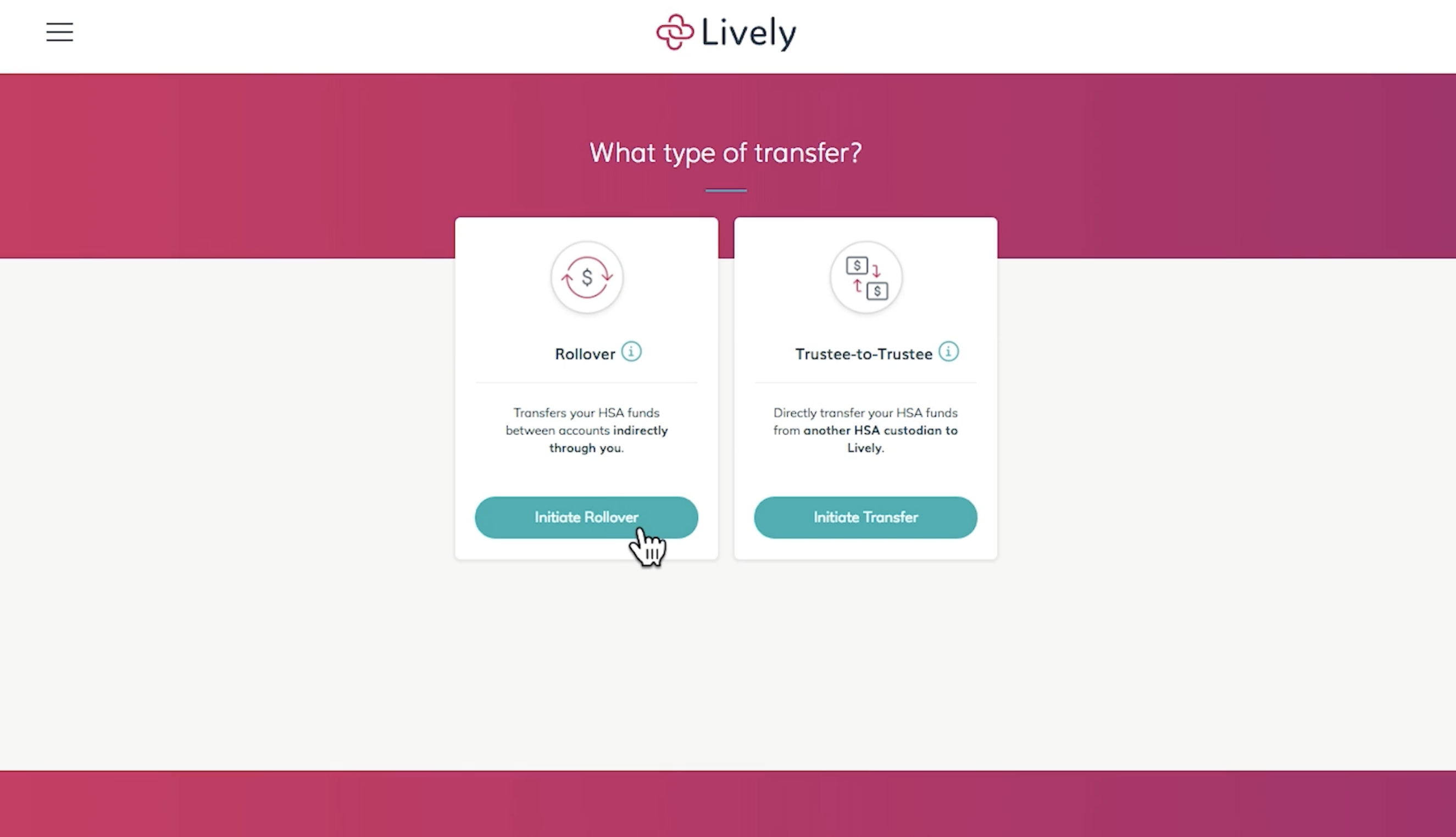

HSA Transfers

3 Minutes

Lively Employee Dashboard Overview

1 Minute

Lively Mobile App Overview

2 Minutes

HSA Investments Overview

Frequently Asked Questions

- How much does Lively cost?

LIvely’s standard pricing is $2.95 per enrolled employee per month, with a monthly minimum fee of $50. This may vary depending on the number of enrolled employees or preferred pricing. Contact sales@livelyme.com to learn more.

Lively is free for individuals and families with no required monthly fees.

- What investment options are available for employees?

Lively offers two industry-leading solutions to help employees build toward their financial goals, both with the capability to start investing right away: Schwab Health Savings Brokerage Account by Charles Schwab and HSA Guided Portfolio by Devenir.

Whether they prefer to be more hands-on or receive personalized guidance, we have a solution that’s right for them. Learn more about Lively’s integrated HSA investment solutions here.

- Can an employer contribute different amounts to different employees?

Employer contributions to eligible employees’ HSAs must be treated as comparable. Comparable contributions must be made to all eligible employees enrolled in a qualifying HDHP, are in the same category of employment (full-time, part-time, former employees, and collectively bargained), same category of coverage (self, self +1, self +2, self +3). In order for it to be considered comparable, an employer must contribute the same dollar amount or percentage amount to everyone in that category. Additionally, the higher coverage categories can’t have a lower contribution amount compared to the lower coverage (self +1 has to be greater than self).

- Are employer contributions tax-deductible?

For sole proprietors, partnerships, and S-corporations, contributions to a partner’s HSA will be treated as a distribution to the partner and included in the partner’s income and may be deductible by the partner but not by the business. For larger corporations (e.g., C-corps), employer contributions are treated as employer provided coverage for medical expenses under an accident or health plan and therefore tax-deductible.

- What happens if an employee leaves the company?

Employees own their HSA and continue to do so if they leave your company or the health plan.

Once Lively receives the termination information, we convert the HSA from an employee account to an individual account and remove the employee’s association to your company. We will send them communications around the ongoing benefits of their Lively HSA and inform them the account is fee-free for them moving forward.

Schwab Health Savings Brokerage Accounts are offered through Charles Schwab & Co., Inc (Member SIPC), the registered broker/dealer, which also provides other brokerage and custody services to its customers. See the Charles Schwab Pricing Guide for Health Savings Accounts for full fee and commission schedules.