Lively’s HSA Snapshot Report Highlights What You Need to Know About HSAs and Your Benefits Mix

- Lively

- 2 min read

The HSA Snapshot report is Lively’s annual look at HSA saving, spending, and investing in 2022 and what it means for brokers and employers for the year ahead.

Inflation, rising costs for both healthcare and everyday items, and a volatile economy continues to impact consumers’ saving and spending habits. While life seems to have mostly resumed its rhythms after the disruption caused by the COVID-19 pandemic, uncertainty still prevails.

In this charged environment, Health Spending Accounts (HSAs) provided account holders with some respite, with tax-advantaged options for saving, spending, and investing. HSA Snapshot, Lively’s fifth annual HSA spend report, explores how Lively’s account holders spent, saved, and invested their healthcare dollars in 2022, and what these habits can show us about national healthcare trends and actions employers and brokers can take as they look ahead to 2024.

The report examines:

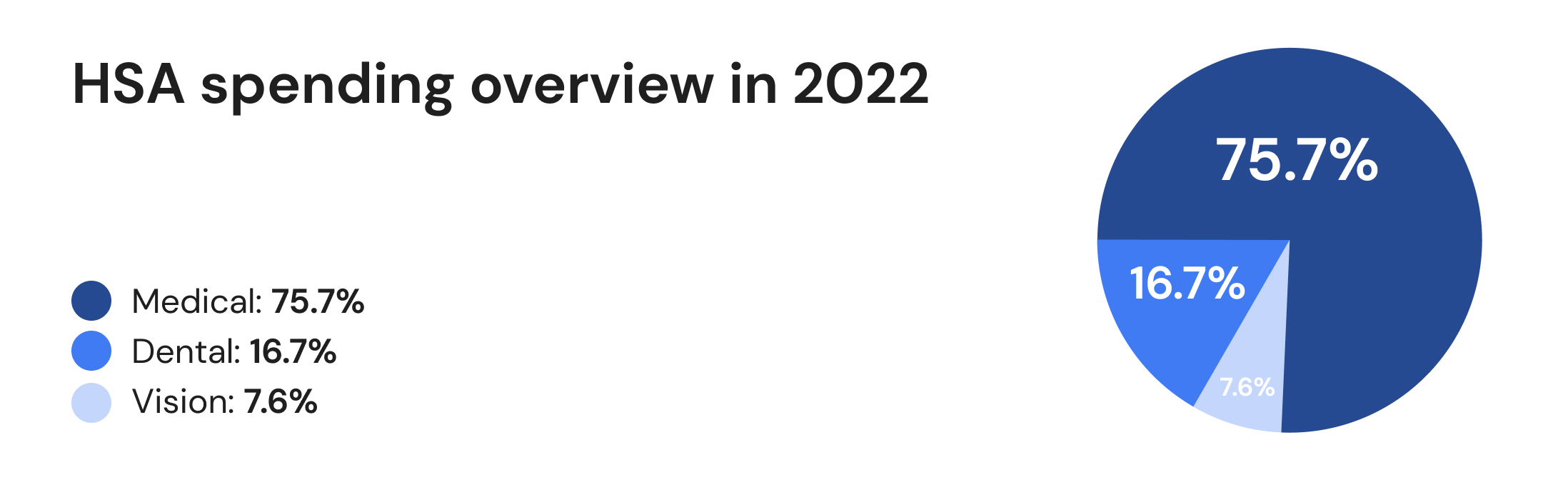

- How HSA account holders spend, especially on routine expenses versus major healthcare emergencies such as hospital visits.

- HSA consumer spending habits, including year-over-year changes since 2019.

- How Lively account holders saved, spent, and invested their HSA dollars compared to industry averages.

How account holders used their HSAs to pay for healthcare today and plan for the future

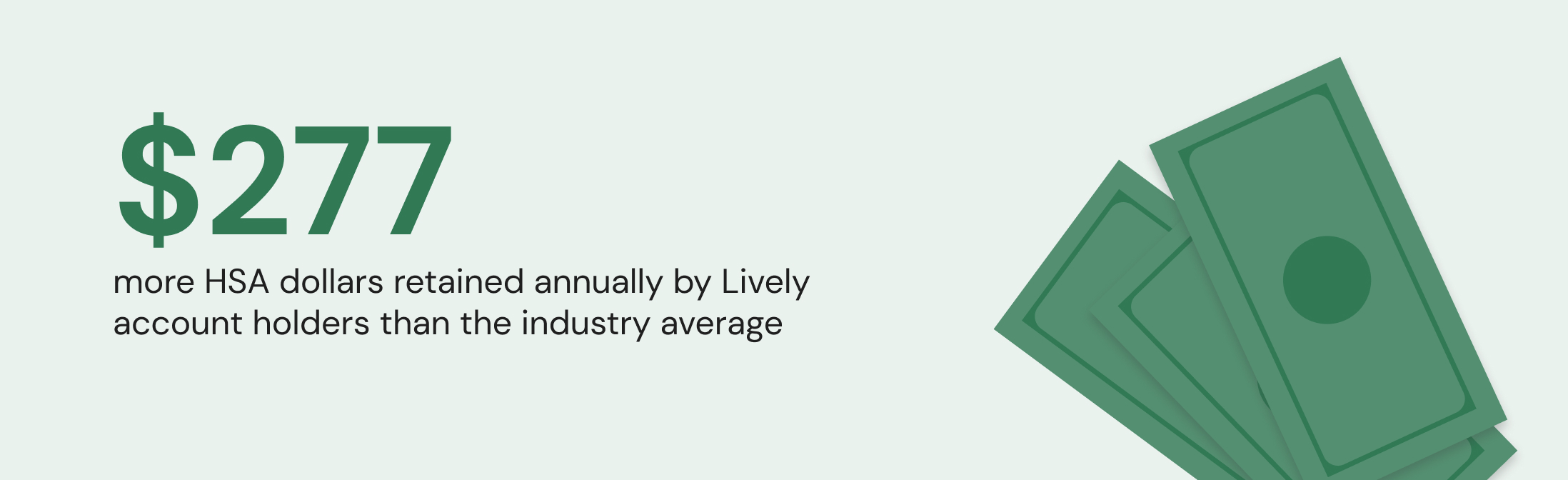

Overall, the report found that while account holders continue to use HSAs for routine healthcare spending, hospital visits and vision and eyewear spending increased, perhaps indicating that people are getting care and services they need that they put off during the pandemic. It also put a spotlight on the critical difference HSA education and the ability to easily invest can make on account holder behavior, as Lively’s account holders save and invest more than the industry average as reported by the Devenir 2022 year-end report.

Key findings include:

- Spending on hospital visits increased by nearly 14% from 2021.

- Spending on vision and eyewear increased by over 150% from 2021.

- Spending on mental health only represents .21 percent of all HSA spending and has fallen over the past few years.

- Lively account holders invest at more than twice the rate of the average HSA account holders.

- Lively account holders save more than the average account holder.

For detailed insights and analysis, read the report.

Crucial action items for brokers and employers to drive HSA and benefits adoption

As benefits brokers and their clients analyze their employees’ needs and make decisions about how to support employees’ health in the upcoming year, the report offers critical action items, including:

- Work with an HSA provider that offers an easy-to-use platform that gives account holders options and flexibility for how they manage their account.

- Investing in HSA education for account holders and employers is critical.

- Consider HSAs as part of a larger, comprehensive benefits strategy and bundle your benefits offering with accounts like LSAs, Medical Travel Accounts, and Limited Purpose FSAs.

- Start planning next year’s program now.

For more detailed action plans, read the report.

With HSA contribution limits increasing over 7% in 2024, employers can begin to plan their matching contributions, which can incentivize employees to participate in an HSA, and drive payroll tax savings. Planning the benefits you will offer early and how you will support employees' financial health and wellness will ensure you remain competitive and get the most for your budget now.

Read the report

For detailed insights, analysis, and how to get started on these action items, get the full report.

Disclaimer: the content presented in this article are for informational purposes only, and is not, and must not be considered tax, investment, legal, accounting or financial planning advice, nor a recommendation as to a specific course of action. Investors should consult all available information, including fund prospectuses, and consult with appropriate tax, investment, accounting, legal, and accounting professionals, as appropriate, before making any investment or utilizing any financial planning strategy.