Make your money work harder

Take advantage of tax-free investing to build your savings. With Schwab Health Savings Brokerage Account from Charles Schwab and HSA Guided Portfolio from Devenir, you have access to two industry-leading investment solutions that align with your personal strategy and financial goals.

Control when and how to invest with different investment access options

Fund with one-time, sweep, or recurring transfers

Monitor from the convenience of your Lively dashboard

Schwab Health Savings Brokerage Accounts are offered through Charles Schwab & Co., Inc (Member SIPC), the registered broker/dealer, which also provides other brokerage and custody services to its customers. See the Charles Schwab Pricing Guide for Health Savings Accounts for full fee and commission schedules.

Spend, track, and get reimbursed effortlessly

We provide easy access to the tools you need to use your HSA funds on eligible expenses and track your expenditures.

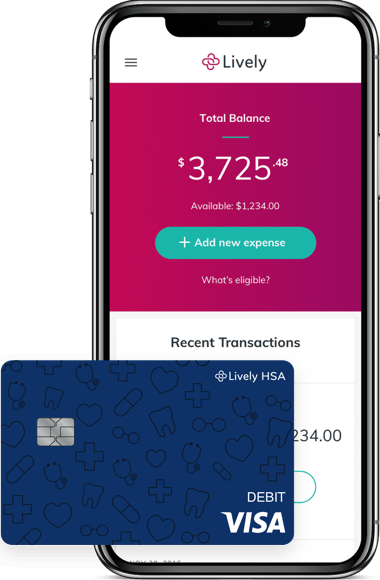

Pay for medical expenses with your debit card

Use it at your doctor’s office, pharmacy, or other qualified providers. Add it to your mobile wallet so you always have access to your funds.

Add items for reimbursement

For purchases not made on the Lively HSA debit card, you can add expenses to be reimbursed now or later.

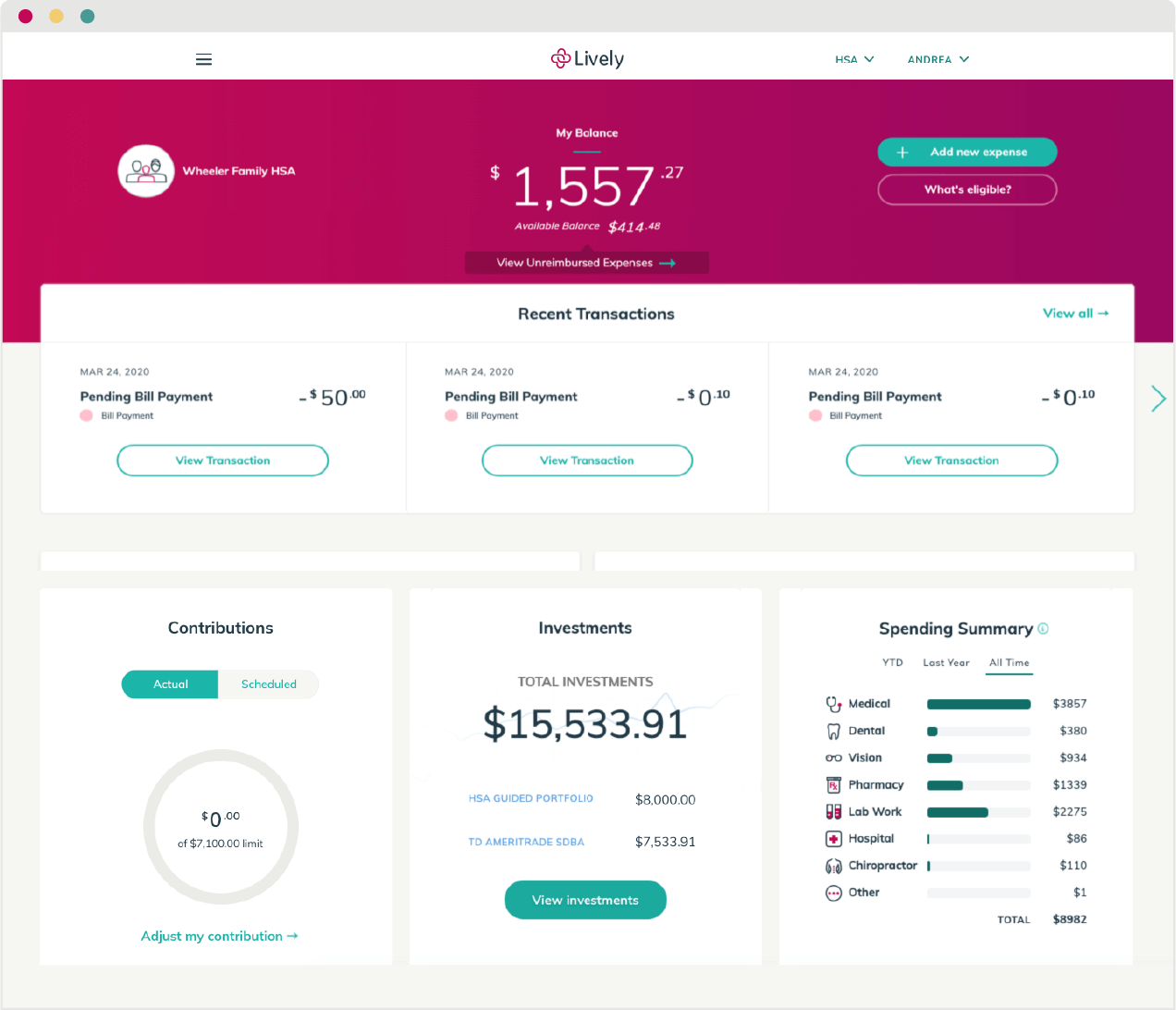

See where you're spending

Categorize receipts and review your spending summary in real-time.

Track deductible spending in real-time

See what you have paid and what remains for your health plan deductible and out-of-pocket costs, right in your dashboard.

Get quick access to tools & support

Resources

We’ve created a suite of resources to help you understand and take full advantage of your HSA. Our calculators provide guidance on how much to contribute each year and how your savings will grow over time.

Support

No matter how you want to start a conversation, we’re here to help you via phone, email, or chat.

Easy to use accounts for individuals and family members, so you can start saving now

If you have an eligible, high-deductible health plan, you can open an HSA today. Getting started with Lively is easy:

- Open your free account with Lively online with no paperwork and check your eligibility status

- Decide how much you want to contribute to your HSA, up to the annual contribution limits. These are set by the IRS each year and differ whether you have an individual or family plan

- Set up your account with Lively walking you through it each step of the way, including any rollovers or transfers so you can consolidate your savings. The entire process takes just a few minutes and Lively support is available for any questions.

- Use your account balance to pay for qualified medical expenses with your Lively debit card. If you paid out of pocket, you can submit a reimbursement from your online dashboard or mobile app

- Enjoy confidence, peace of mind, and the ability to save on eligible healthcare expenses, whether unplanned or routine

Manage your HSA Funds easily and confidently

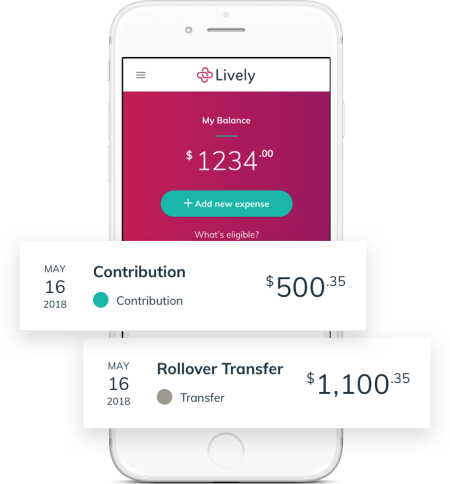

Lively makes accessing your HSA easier than ever. From your Lively online dashboard and mobile app you can:

- Track your contributions, spending, and investing from one simple dashboard

- Choose when and how to invest your HSA funds

- Boost your retirement savings — HSA funds never expire and after age 65 can be used penalty-free on non-medical expenses