The Basics of HSAs: Qualifications, Uses, and More

- Lauren Hargrave

- 4 min read

Are you wondering: “What is an HSA?” Discover the basics. Including the qualifications for opening and contributing to a health savings account, how much you can contribute annually, how to use your account for qualified medical expenses, and more.

It’s a fact. The cost to be - and stay - healthy rises each year. And even the comprehensive (expensive) health insurance plans are covering less for the cost of care. So what’s a person to do? Open an HSA.

A Health Savings Account (HSA) allows you to set aside money on a pre-tax basis to pay for qualified medical expenses. You, your employer, and even friends and family can contribute money to your HSA. The contributions are tax-deductible and never expire. So you can save them for a rainy day, retirement, or to help pay for an expensive procedure you have coming up.

How do I qualify for an HSA?

To qualify for opening and contributing to an HSA, you must meet these criteria:

- You must enroll in a High-Deductible Health Plan (HDHP).

- You have no other health coverage except what is permitted under what the IRS defines as "other health coverage."

- You must not be enrolled in Medicare.

- You can’t contribute to a Health Flexible Spending Account (HFSA). But you can contribute to a Dependent Care (DCFSA) or Limited-Purpose FSA (LPFSA) and contribute to a health savings account in the same year.

- You can't be claimed as a dependent on someone else's tax return.

How to enroll and use an HSA

Step 1: Elect a high-deductible health plan during open enrollment.

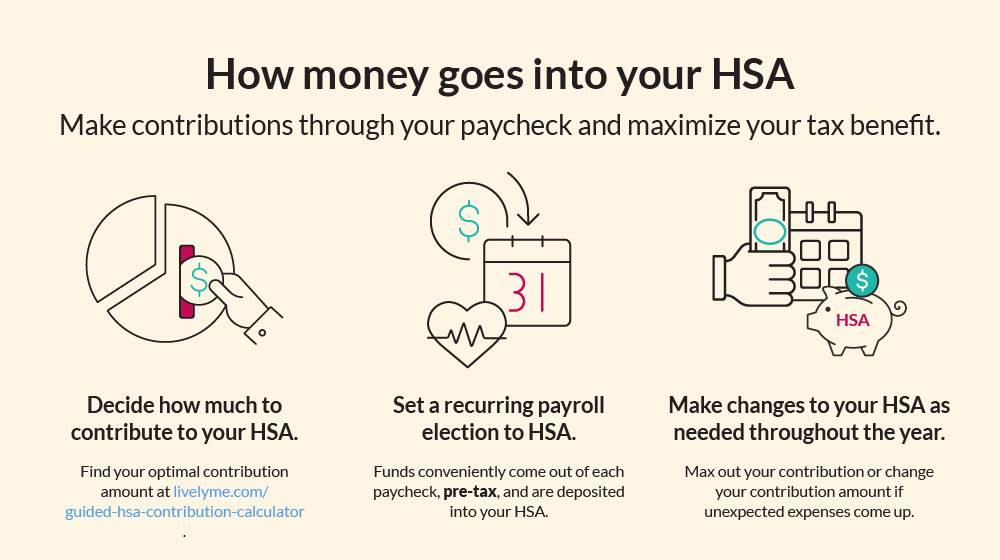

Step 2: Open a health savings account and decide how much you want to contribute.

To enroll in an employer-sponsored health savings account, you'll likely open your HSA during open enrollment. Let your employer know how much you want to contribute for the year up to the IRS contribution limit, which are different whether you are an individual, family, and/or over 55. Your employer may begin making payroll deductions each month.

Your employer may choose to contribute to your HSA. But they’re not required to. If they do, those contributions will count toward your annual limit. But will remain tax-free to you.

Maybe your employer doesn’t offer a health savings account. Or it’s outside of open enrollment and you want to get started on saving for your health care costs today. You can open an HSA with a financial institution in the private market.

With this route, you will make arrangements to fund your HSA with the account administrator. And your contributions will be deducted from your gross taxable income when you pay taxes for that year.

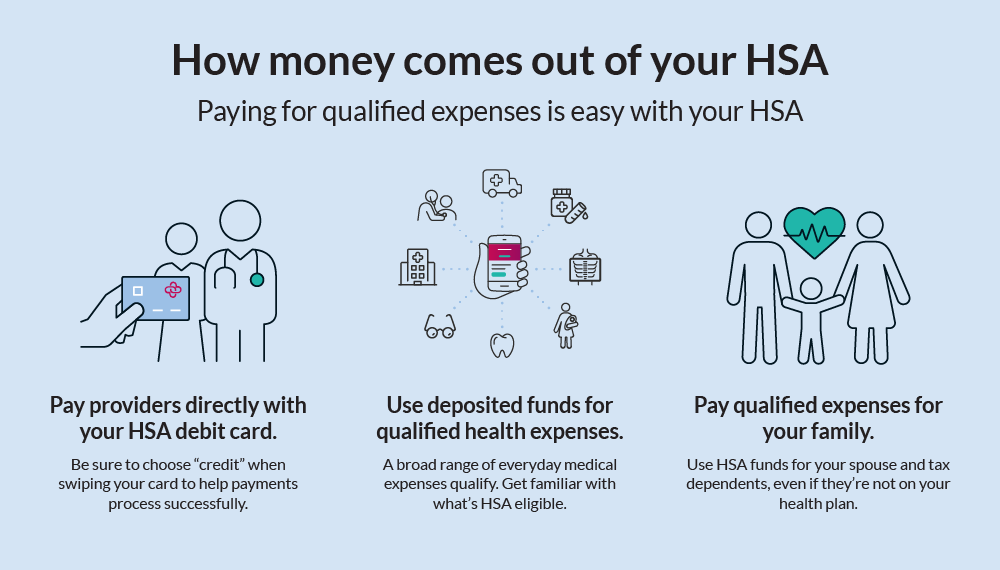

Step 3: Use your funds for qualified medical expenses.

To use your funds, your account administrator may provide a debit card so you can pay for your health care costs at the point of sale. Or you will pay for costs upfront and submit documentation for reimbursement. Your withdrawals are tax-free as long as you use the money to pay for qualified medical expenses. If you use your money for something else, the money you withdrew will be subject to income tax plus a 20% penalty.

Additional health savings account details:

- You own your account so you can take it with you from employer-to-employer (or employer to unemployed).

- Even if you choose a health insurance plan that isn’t an HDHP, you can still use past contributions for out-of-pocket, qualified medical expenses. But you won’t be able to contribute to your account.

- Employer contributions are tax-free.

- If you’re under the age of 65, you must use your contributions for qualified medical expenses.

- Once you reach 65, you can no longer contribute to your account. But you can use your savings to pay for whatever you’d like.

- An HSA offers triple tax savings: pre-tax or tax-deductible contributions, tax-free interest and investment earnings, and tax-free distributions when used for qualified medical expenses.

What can I use my funds for?

HSA-eligible expenses include (but are not limited to):

- Deductibles

- Copays

- Coinsurance

- Out-of-pocket costs related to diagnostic services like x-rays and blood tests

- Prescriptions

- Quality of life enhancers like air purifiers (with a letter of medical need)

- Medical supplies like band-aids and crutches

- Alternative medicine treatments like acupuncture

This list is not exhaustive. For a comprehensive list of IRS-qualified medical expenses check “What’s Eligible."

What happens if I switch employers?

You get to keep your account and every dollar you’ve saved. Although you may not be able to continue contributing to that same account.

If your new employer uses a different health savings account administrator, you will have two options. Roll the HSA from your previous employer into the new account or maintain two different HSAs. One account from your previous employer - from which you can withdraw but not contribute. And one from your current employer into which you can start contributing.

For more details about your specific situation, contact your HR department.

Where can I sign up for a Health Savings Account?

You can sign up for an HSA in two places. Through your employer, if it offers this benefit. Or through a financial institution in the private market.

Here, at Lively, we offer a private-market HSA that allows you to put your contributions into mutual funds or other investments. That way you can access an even greater benefit: growing your money with the market.

As you can see, there are many ways an HSA can help you save money for health care expenses and retirement. A health savings account can also offer security should you lose your health insurance coverage for a period of time. For more information about HSAs, check out our HSA Guide.

Disclaimer: the content presented in this article are for informational purposes only, and is not, and must not be considered tax, investment, legal, accounting or financial planning advice, nor a recommendation as to a specific course of action. Investors should consult all available information, including fund prospectuses, and consult with appropriate tax, investment, accounting, legal, and accounting professionals, as appropriate, before making any investment or utilizing any financial planning strategy.