Rising Healthcare Costs and the Great Resignation

- Lively

- 1 min read

Lively’s third annual Wellness and Wealth Report examines the effect of the Great Resignation and rising healthcare costs on Americans and action items for brokers and employers.

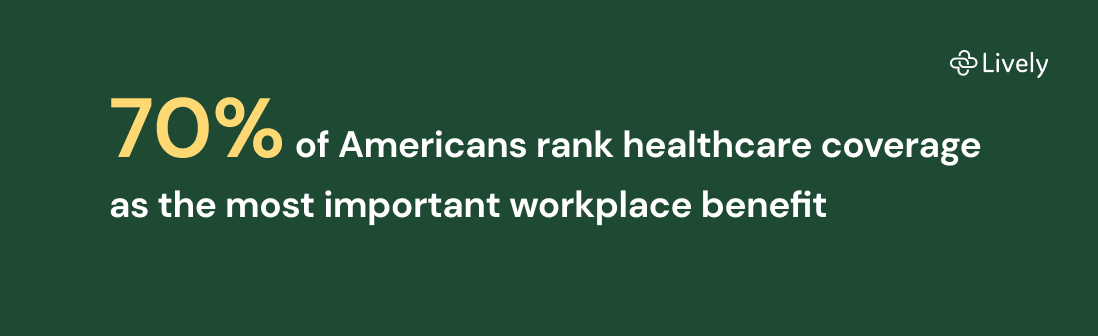

As Americans contend with rising prices, economic volatility, and ongoing stress and burnout, how can employer-sponsored benefits help? In this climate, where employees are quitting their jobs in record numbers, healthcare has emerged as the most important benefit that employers can offer. It is also a benefit that can help employers hire and retain talented employees amidst the Great Resignation.

Lively’s report, Benefits and the Great Resignation, our third annual Wellness and Wealth Report, examines the role workplace benefits play in Americans’ lives. It enables brokers, benefit consultants, and employers to understand the needs of Americans and offer a competitive benefits package.

The report offers insights into:

- How rising healthcare costs are preventing the majority of Americans from achieving their financial goals

- Why healthcare is the most important benefit that employers can offer and top of mind for employees when switching jobs

- The gaps in access to mental health care, despite increased focus

The report outlines action items brokers, benefit consultants, and employers can take to remain competitive and help Americans meet their financial and wellness goals by:

- Offering a holistic financial wellness benefits package

- Selecting benefits platforms based on education and ease of use

- Investing in benefits education

- Giving employees options for accessing and paying for mental health care

For deeper insights into Americans’ understanding of healthcare and benefits, and how brokers, consultants, and employers can better position their benefits offering and help boost hiring and retention, download the report.

Disclaimer: the content presented in this article are for informational purposes only, and is not, and must not be considered tax, investment, legal, accounting or financial planning advice, nor a recommendation as to a specific course of action. Investors should consult all available information, including fund prospectuses, and consult with appropriate tax, investment, accounting, legal, and accounting professionals, as appropriate, before making any investment or utilizing any financial planning strategy.