Understand the Employee Benefits That Make the Most Impact

- Lively

- 1 min read

Our second annual report that captures critical insight from HR leaders about the employee benefits that make an impact for retention and cost savings and provides employers and brokers with action items.

In an environment of economic volatility and rapidly shifting employee expectations, the pressure is on HR leaders, and the benefits brokers that serve them, to offer employee benefits that make an impact when it comes to employee retention, recruitment, and cost savings. Lively’s second annual Employee Benefits Pulse Check captures and shares the decisions that HR leaders are making around benefits right now. In partnership with CITE research, we anonymously surveyed 250 HR leaders across the United States and multiple industries to capture key data and understand current trends around what employee benefits.

The report provides data driven responses to the following questions:

- What are the reasons behind why employers are adding new benefits or improving existing benefits?

- What benefits are the most effective for attracting and retaining employees?

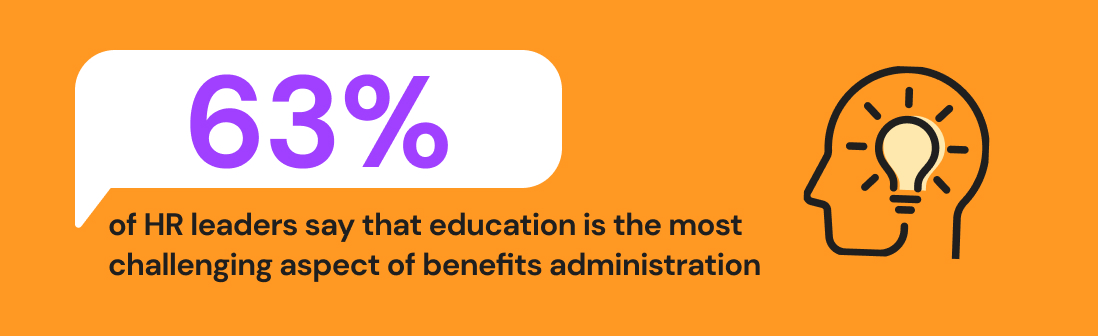

- What are the most challenging aspects of benefits administration and how can employers drive better benefits adoption?

The report identifies four key trends around how employers are:

- Adding bonuses, 401(k) matching and other incentives to retain employees

- Offering innovative benefits such as Lifestyle Spending and Medical Travel Accounts and where these can be improved

- Leveraging benefits to combat employee financial stress

- Utilizing benefits education and working with benefits providers to drive adoption

It provides key action items for brokers and employers to enable them to:

- Understand what’s most valuable to employees and respond to employee needs

- Identify benefits to add or improve, while staying within budget

- Consider adding Lifestyle Spending and Medical Travel Accounts to further meet employee needs and create an inclusive workplace culture

- Identify benefits providers that support employee education and benefits adoption during open enrollment and all year long

Read the full report in order to understand how to choose the most impactful, and cost effective, benefits for employees and to better keep up with client and employee demand during open enrollment and as you plan benefits strategies for 2024.

Disclaimer: the content presented in this article are for informational purposes only, and is not, and must not be considered tax, investment, legal, accounting or financial planning advice, nor a recommendation as to a specific course of action. Investors should consult all available information, including fund prospectuses, and consult with appropriate tax, investment, accounting, legal, and accounting professionals, as appropriate, before making any investment or utilizing any financial planning strategy.