Health and Wellness Account Resources

Guides, articles, how-to’s, and more covering HSAs, FSAs, HRAs, Lifestyle Spending and Medical Travel Accounts, and general financial health and wellness.

Guides

Featured Content

article

Resources for Open Enrollment Success

article

How Can an HSA Help Bridge the Retirement Gap?

article

What Brought Our VP of People to Lively

article

How to Conduct a Mid-Year Personal Finance and Wellness Review

article

What Do Women Need to Know About Their HSA?

article

What can a Lifestyle Spending Account be Used For?

article

Lively’s Platform Now Has Over $1 Billion in HSA Assets

article

How To Use an HSA Calculator To Plan for Tax Savings

article

Can I Pay for Medical Transportation with an HRA, HSA, FSA, or Medical Travel Account?

article

What is an Integrated or Standard HRA?

article

What is Group Health Insurance?

article

10 Habits of Financially Secure People

article

10 New Year's Financial Resolutions

article

Are HSAs Recession-Proof?

article

Turning 26? Here’s How Long You’ll Continue on Your Health Insurance Plan

article

How Much Should You be Spending on Health Insurance Each Month?

article

How to Sign up For an HSA When Your Employer Doesn't Offer One

article

Why Do Open Enrollment Periods Exist for Health Insurance?

article

How Can an HSA Account Help You Combat Inflation?

article

Inside Lively's Hiring Process

article

Healthy Habits for Your Health Savings Account

article

Lively’s Customer-Centric Approach

article

A Guide to COBRA Insurance

article

Lively’s Values: Where They Came from and How We Live by Them

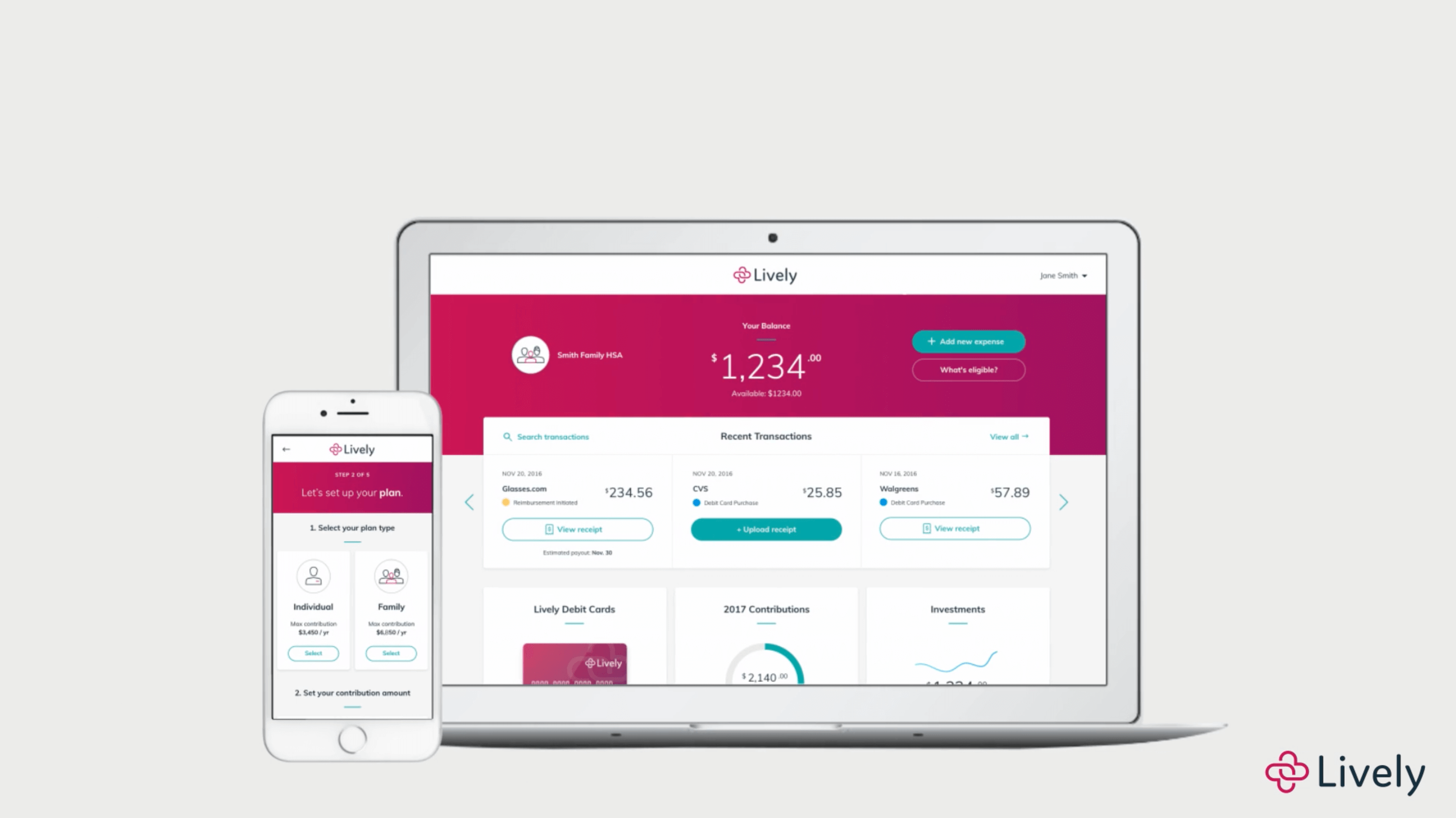

Calculators

Easily compare health plans, determine yearly HSA contribution amounts, and forecast HSA savings.

Calculators

Easily compare health plans, determine yearly HSA contribution amounts, and forecast HSA savings.

Frequently Asked Questions

- What is an HSA?

An HSA can be an interest-bearing health account used for qualifying medical expenses, with the IRS's maximum contribution limits set annually. The HSA can only be used with a qualifying high-deductible health plan (HDHP), traditionally known for lower premiums and high-deductibles. A qualifying HDHP has a minimum deductible and out-of-pocket maximum that is set annually by the IRS.

- Am I eligible to open an HSA?

To qualify for an HSA, you must meet the following criteria:

- You’re covered by a qualifying High-Deductible Health Plan (HDHP).

- The HDHP is your only health insurance coverage. Meaning, you don’t have supplemental coverage from a spouse or other family member (dental and vision is fine).

- You don’t have or use a General Purpose FSA (Flexible Spending Account). But, you are allowed to have a Limited Purpose FSA for dental, vision, or a Dependent Care FSA. Note: You can have an existing HSA and open an FSA. Your HSA funds will remain, but you cannot continue contributing to the health savings account.

- No one else can claim you as a dependent on their tax return.

- You’re between the ages of 18 and 65 and not enrolled in or eligible for Medicare (Part A and Part B) or Medicaid.

Read more on the health plan and personal requirements for HSA-eligibility.

- I no longer have an HDHP. Can I still use my HSA?

You can't contribute to your HSA if you're not longer enrolled in an HSA-qualified health insurance plan. However, you can still pay for qualified out-of-pocket medical expenses with your HSA, allow your account to accrue interest, invest the funds, or use them for qualified medical expenses.

- What are the interest rates for a Lively HSA?

Interest is paid on cash balances within your Lively HSA. The annual percentage yield (APY) can be found here

- Is there a fee to add investments?

Lively offers two ways to invest with our Schwab Health Savings Brokerage Account option: invest anything above $3,000 for no access fee or invest with no minimum requirements after a $24 annual access fee. (Additional fees from Charles Schwab may apply, see details here.)

Lively charges a 0.50% annual management fee for access to investment capabilities through the HSA Guided Portfolio by Devenir, including automated features such as rebalancing. The fee is based on invested assets and debited quarterly. (Additional expense ratio fees may apply, see details here.)

Be sure to consult with a financial planning and/or tax professional as needed to understand your options.

Schwab Health Savings Brokerage Accounts are offered through Charles Schwab & Co., Inc (Member SIPC), the registered broker/dealer, which also provides other brokerage and custody services to its customers. See the Charles Schwab Pricing Guide for Health Savings Accounts for full fee and commission schedules.